Dena Standley is a seasoned paralegal with more than 20 years of experience in legal research and writing, having received a certification as a Legal Assistant/Paralegal from Southern Technical College.

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Summary: You can use settlement agreements to resolve disputes of all kinds. These could be employment disputes, medical malpractice, marital disputes, defective products, debt collection lawsuits, etc. Settlement agreements are legally binding, so you should understand what to ask for before signing. Below is SoloSuit's simple guide to settlement agreements.

A settlement agreement can help you bypass the lengthy and costly litigation process. For example, you can offer to settle instead of enduring a debt collection lawsuit. The court will dismiss the case if the debt collector accepts your offer.

The settlement agreement is a legally-binding document whose terms both parties must fulfill. So, before agreeing to or offering your opponent a settlement agreement, you must understand how these documents work and what you should request. You also need to ensure the settlement offer is selling you well.

Keep reading to learn a bit about settlement agreements. Then we will discuss what you need to ask for in yours.

Whenever you are part of a dispute, like in a civil case, you can resolve your issues in or out of court. The decision you make depends on the type of dispute and each party's willingness to find a resolution. Settlement agreements are often reached after arbitration. If you have been sued, SoloSuit can help you force the suit out of court with a Motion to Compel Arbitration.

If you settle a disagreement outside the court, you typically need a settlement agreement. The document states the terms under which the court may dismiss an ongoing lawsuit.

The party making the offer should sign in acceptance of the conditions therein. It is good practice for the opponent to sign and date to show that they agree with you.

In essence, the settlement agreement outlines the resolution to a dispute. Opposing parties negotiate, compromise, and sometimes change the terms before reaching an agreement.

Settlement agreements serve in almost all areas of life. Such agreements can help resolve issues resulting from:

A well-drafted settlement agreement should contain all the necessary details. If you are the one drafting the document, include the following:

Remember that a settlement agreement does not address liabilities. Its sole purpose is to bring the dispute to an end.

Also, the court only enforces the agreement as is. It is not the judge's duty to set the settlement conditions for you. So it is best to research and determine the facts of the case and the best outcome a settlement agreement can provide. You may need a lawyer to help you draft the document.

As we have mentioned, settlement agreements work for all kinds of disputes. So what you include will depend on the issue you hope to settle.

In general, any a settlement agreement should ask for the following.

When drafting a settlement agreement, you should ask that the opposing party agree to the settlement's terms. For instance, a debt collector can accept to withdraw a lawsuit. Let’s explore an example.

Example: XYZ debt collectors sued Dan. He knew that the debt was his and the amount was correct. But he also knew that he needed help to afford the total amount. So after filing his Answer with the court and sending a copy to XYZ's attorney, he used SoloSettle to propose a debt settlement. Dan asked that XYZ Collection accept a lump-sum payment of a percentage of his debt, withdraw the lawsuit, and mark the account as paid. The company agreed and drafted the debt settlement agreement with the conditions mentioned above. Dan can rest knowing he is free of collection calls and a stressful case.

The consideration is the offer that ends the dispute. For instance, in a debt collection lawsuit, it is the amount of money you are offering. In a different type of dispute, it may not involve money; such as when you and your soon-to-be ex-spouse agree to split babysitting duties equally.

Suppose you are injured in a car accident and prefer to resolve the issue without a lawsuit. In the personal injury Settlement Agreement, you can ask the driver who hit you to pay $1,000 in medical bills (if that's the cost you incurred) and an additional $5,000 for loss of income during recovery.

SoloSuit has a proven history of helping consumers settle debt collection lawsuits for much less than they owe.

You should state any deadlines for both parties taking or stopping specific actions.

For example, if you propose a debt settlement amount, mention the date you must make the payment.

The settlement agreement typically releases one or both parties from a possible future action, such as a lawsuit. Therefore, you should mention the date when the contract goes into effect. Is it on the day both parties sign, or is it when the court dismisses the case?

Both parties should clearly understand and agree with the set dates.

Remember to sign and date the settlement agreement. You should also allow space for your opponent to sign and date. Any mediators or witnesses present can also sign, although this is usually unnecessary.

Like other settlement agreements, a debt settlement agreement is a legal document that is filed into a debt collection lawsuit when the two parties have reached a consensus on how to resolve the dispute.

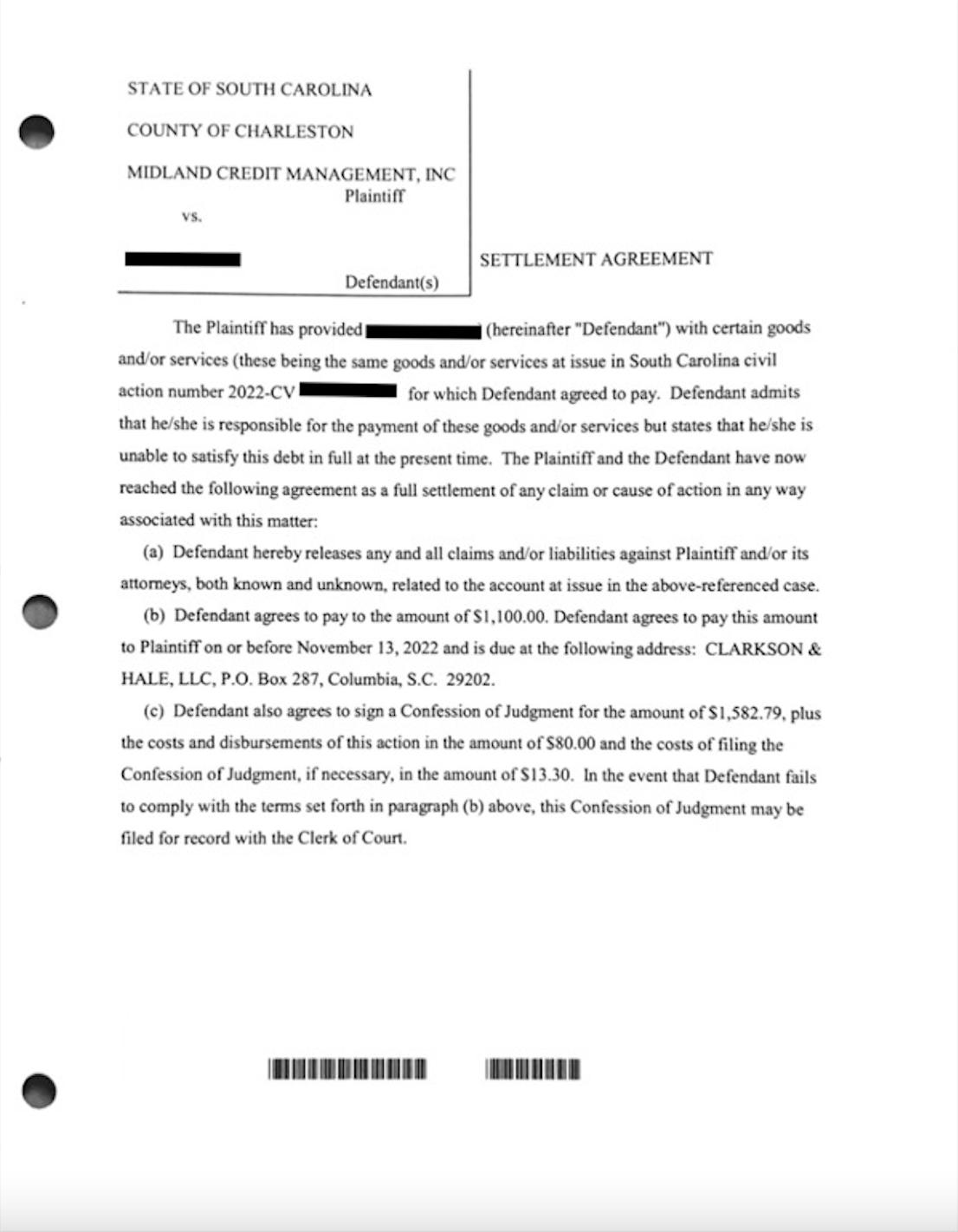

Below is an example of a debt settlement agreement in a South Carolina debt lawsuit:

Debt settlement agreements can be a lifesaver if you are facing a debt collection lawsuit. They take away the stress, time, and money that come with court cases.

Many debt collectors are willing to settle a debt for less than the original amount owed.

However, before signing a settlement agreement, you need to be sure that you understand and agree with the terms. You should also state your demands and clearly explain the reason for the dispute, as shown in this sample debt settlement agreement.

Keep in mind that once the court dismisses the case, it is not under obligation to mediate between you and your opponent. The judge can only enforce the terms of the contract. So, only sign when you are satisfied.

You may need to speak with an attorney to get the legal advice you need. Or you can check out our article on How to Make a Debt Settlement Agreement.

SoloSuit makes it easy to fight debt collectors.

You can use SoloSuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt.

SoloSuit's Answer service is a step-by-step web-app that asks you all the necessary questions to complete your Answer. Upon completion, we'll have an attorney review your document and we'll file it for you.

An Affidavit is a written statement made under oath and submitted as a court document.

An Affidavit alone doesn't require a response. However, Affidavits are usually served with another document like a Complaint and Summons. If you received a Complaint and Summons you must respond by filing an Answer.

After starting an Answer, most people offer to settle because they want to wrap up the case.

If you received a collections letter, that means you are in collections.

The next document people send is a Debt Validation Letter. This will require the collector to prove you owe the debt.

If you received a Complaint and Summons, that means you are being sued.

The next document people file is an Answer document. This will prevent you from losing automatically.

After starting an Answer, most people offer to settle because they want to wrap up the case.

If you received Interrogatories, that usually means you are in the second stage of a lawsuit: discovery. In discovery both parties can request information from each other.

People respond to the Interrogatories with a written response. The response needs to be submitted by the deadline which is usually around 30 days.

Many people settle the lawsuit at this stage.

A Memorandum is a court document that argues for or against a Motion. A Memorandum is usually filed with a Motion.

The next document people file is a Memorandum Opposed to the Motion. For example, if the person suing you filed a Motion to Dismiss and a Memorandum in Favor of the Motion to Dismiss, you could file a Memorandum Opposed to the Motion to Dismiss.

At any point in a lawsuit, many people choose to settle to get to a quicker resolution.

A Motion is a court document that asks a judge to do something. Common motions include a Motion to Dismiss or a Motion for Summary Judgment. A Motion for Summary Judgment asks the judge to declare the filer the winner immediately.

The next document people file is a Memorandum Opposed to the Motion.

At any point in a lawsuit, many people choose to settle to get to a quicker resolution.

If you received a Motion to Dismiss, then the person suing you is pretty much giving up and asking the judge to dismiss the lawsuit. Dismissing the lawsuit will remove it from court. A case can be dismissed with or without prejudice. If it's dismissed without prejudice, the person can sue you again for the same issue.

If the person suing you is filing for dismissal, that's almost always a good thing. It usually means you won. 🎉

An Order is a written statement made by a judge in a lawsuit. Orders are usually approving or denying a Motion. For example, an Order for Default Judgment may be filed granting a Motion for Default Judgment. Don’t confuse a Proposed Order with an Order. Debt collectors will frequently file a Proposed Order for Default Judgment; it is only a proposal, not an actual order.

Orders don't require a response.

At any point in a lawsuit, many people choose to settle to get to a quicker resolution.

If you received a Petition and Citation, then you are being sued. These documents are titled Complaint and Summons in most states.

The next document you need to file is an Answer to the Petition. This will prevent you from losing automatically.

After starting an Answer, most people offer to settle because they want to wrap up the case.

If you received a Request for Admissions, that usually means you are in the second stage of a lawsuit: discovery. In discovery, both parties can request information from each other.

The next document people file is a Response to the Request for Admissions. It usually needs to be filed within about 30 days. If you don't file a response, the court will usually consider the statements in the request to be true.

At any point in a lawsuit, many people choose to settle to get to a quicker resolution.

If the last document you received is a Writ of Garnishment, that means your wages are about to be garnished. You've already lost the lawsuit.

If you never filed an Answer, there still may be hope. The next documents people file in this situation are a Motion to Set Aside Judgment and an Answer. The Motion to Set Aside Judgment asks the judge to give you a second chance because you never responded to the lawsuit, and the Answer responds to the lawsuit.

Even at this stage people sometimes settle.

This calculator is for educational purposes only.

Here's a list of guides for other states.

Being sued by a different debt collector? Were making guides on how to beat each one.

You can ask your questions on the SoloSuit forum and the community will help you out. Whether you need help now are are just look for support, we're here for you.

Is your credit card company suing you? Learn how you can beat each one.

Need more info on statutes of limitations? Read our 50-state guide.