A church budget is a financial plan that outlines the expected income and expenditures of a church for a specific period. It helps manage resources effectively and ensures that funds are allocated to various church activities and needs.Using a church budget template provides a structured format, saving time and ensuring all financial aspects are covered. It promotes transparency and accountability in financial management, aiding in better decision-making and resource allocation.

9 min read Brian Otieno Written ByContent Writer & Editor Brian Otieno is a skilled writer with a robust background in business and information technology. Holding a Master's degree in Business and Information Technology, he masterfully bridges these two fields in his writing. With his talent for demystifying complex concepts, Brian has made a name for himself in the realms of IT and business writing. His practical experience is further bolstered by a Software Engineering certificate from ALX, enhancing his ability to communicate intricate technical ideas effectively. Brian's expertise are helping our users navigate and understand our document templates.

Managing a church’s finances is a sacred duty that requires diligence, wisdom, and a heart for stewardship. Proverbs 21:5 reminds us, “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” Just as we seek God’s guidance in our spiritual journey, we must also seek His wisdom in managing our church’s resources. A well-structured budget is essential for ensuring the financial health and sustainability of your church.

In this blog post, we will explore the features of the free church budget template, discuss its benefits, and provide practical steps for creating an effective budget. Additionally, we will offer valuable guidance on raising funds to support your church’s missions and activities. Our goal is to equip you with the tools and knowledge needed to support your church’s missions and activities faithfully. Engage with us as we embark on this journey to financial stewardship, guided by faith and prudence.

A church budget is not just about tracking income and expenses; it serves multiple vital purposes:

Creating an effective church budget involves several crucial steps:

To start, collect all relevant income and expense records from previous years. It is important to review past financial reports to identify trends and patterns that will help in making informed decisions.

Next, estimate the regular income that can be expected from tithes, offerings, and other sources. Consider both historical data and future plans to account for potential growth or decline in income.

Differentiate between fixed expenses, such as salaries, and variable expenses, like event costs. Prioritize essential spending to ensure that critical operations are funded first and foremost.

Once income and expenses are projected, balance the projected income against the estimated expenses. It is also wise to create contingency funds to cover unexpected costs that may arise.

Conduct regular reviews of the budget to ensure it remains accurate and relevant. Make the necessary adjustments to address any financial changes or challenges that occur throughout the year.

By following these steps, church leaders can create a comprehensive and effective budget that supports their mission and operational needs.

Provide regular financial updates to the congregation. Transparency builds trust and encourages continued support. Share detailed reports during church meetings and through newsletters.

The church budget template is designed to assist you in effectively managing your financial resources. This comprehensive template facilitates detailed tracking of both income and expenses and enables the church to plan and allocate its budget to support its various missions and activities. It is designed to be accessible and versatile, available in Excel (XLSX), Google Sheets, Excel Template (XLTX), and OpenDocument Spreadsheet (ODS) formats. This template makes sure you can efficiently manage the finances of your church in the format that best meets your needs, whether you prefer the reliable functionality of Excel, the teamwork capabilities of Google Sheets, or the compatibility provided by open-source software like OpenDocument.

The template comprises several sheets, each serving a unique purpose: Summary, Income, and Expenses. These sheets collectively ensure a thorough and organized approach to financial planning.

This church budget summary sheet is designed to offer a clear and concise overview of your church’s financial status. By linking data from detailed income and expense sheets, it provides an automated and comprehensive snapshot of your financial health. This sheet facilitates easy tracking and analysis of financial performance over the years, ensuring accurate budget management and effective decision-making. The inclusion of historical data, a visual budget summary, and sections for additional notes and approvals ensures that all aspects of the budget are thoroughly documented and easily accessible for review.

The Cover Sheet is your go-to overview for understanding the financial status of your church. It consolidates data from both the Income and Expense Sheets to provide a high-level snapshot of your financial health. This sheet is designed to offer a quick and comprehensive summary, making it easier to track performance, identify trends, and make informed decisions.

The Cover Sheet pulls current-year data directly from the Income and Expense Sheets and ensures that all figures are up-to-date and accurately reflect the church’s financial status. The automation and linkage between these sheets save time and reduce the risk of errors.

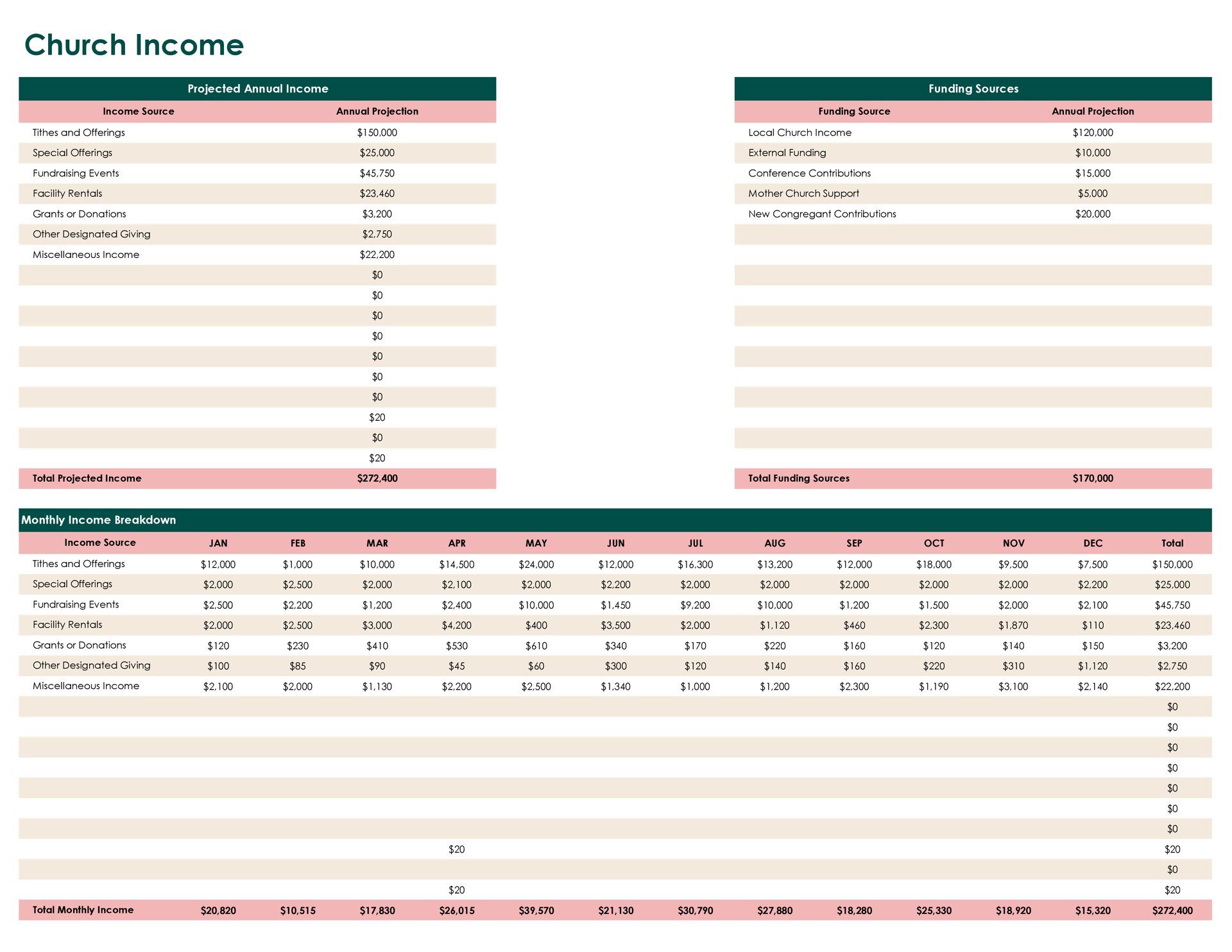

The Income Sheet details the various sources of projected income for your church for the current year, both annually and monthly. This sheet helps you track expected income from sources such as tithes and offerings, special offerings, fundraising events, facility rentals, grants or donations, and miscellaneous income.

The Income Sheet is linked to the Cover Sheet, where the total anticipated income for the budget year is summed up. This linkage ensures that the budget summary is always accurate and reflects the latest data entries.

The Church Expense Sheet provides a detailed breakdown of your church’s projected expenditures for the current year, both annually and monthly. This sheet ensures you have a clear view of where your money is being spent and helps maintain financial stability.

The Expense Sheet is linked to the Cover Sheet, where the projected expenses for the current year are displayed. This integration ensures the budget summary reflects an accurate and comprehensive financial overview.

Using a template is a smart and efficient way to manage your church’s finances. A template provides a structured and organized approach to tracking income and expenses to ensure nothing is overlooked. It simplifies the budgeting process with automated calculations, reduces the potential for errors, and saves valuable time. The customizable fields enable it to be tailored to your church’s specific financial needs, while visual data representations, such as graphs, make it easy to understand financial trends and performance. By using a budget template, you can enhance transparency, improve financial planning, and make certain that resources are effectively allocated to support your church’s mission and activities.

Research and apply for grants from foundations and organizations that support religious and community initiatives. Grant writing can be a valuable skill for securing additional funds.

Raising funds effectively is crucial for supporting the various missions and activities of a church. Here are some strategies to enhance your fundraising efforts:

To diversify income sources, encourage regular giving through sermons, bulletins, and online platforms for tithes and offerings. Organize special offerings during significant events such as Easter, Christmas, and other church celebrations. Plan engaging fundraising events like bake sales, car washes, and silent auctions to involve the community and raise funds. Apply for grants from foundations and seek donations from local businesses and philanthropists, while also setting up an online giving platform to facilitate easier donations from members.

Engage the neighbourhood by holding inclusive events like fairs, concerts, and sporting competitions when organizing and publicizing fundraising activities. Organize church-specific events like prayer breakfasts, charity runs, and talent shows to bring the congregation together and raise funds. Use social media, church newsletters, and local newspapers to promote your events, creating engaging content that highlights the cause and potential impact of the funds raised. Recruit and train passionate volunteers to help organize and run these events.

Financial Wisdom: Establish a reserve fund to cover unexpected expenses or emergencies. Aim to save a percentage of your annual budget to build a financial cushion.

Cultivating relationships with donors is essential. Build personal connections with major donors by inviting them to church events and keeping them informed about the impact of their contributions. Recognize and thank donors both publicly and privately, send personalized thank-you notes, and acknowledge them in church bulletins and newsletters. Keep donors updated on the progress and impact of their contributions through regular reports and updates.

Leveraging technology can significantly boost your fundraising efforts. Use secure online giving platforms that are user-friendly and accessible on various devices. Launch social media campaigns to reach a broader audience and use engaging stories, images, and videos to highlight the church’s needs and goals. Send regular emails to the congregation and potential donors with detailed information about current fundraising needs and successes.

Implementing stewardship programs can also enhance fundraising. Conduct educational workshops on financial stewardship to educate church members about the importance of regular giving and how they can contribute to the church’s mission. Run annual or biannual stewardship campaigns to encourage members to pledge regular contributions, providing materials that explain the church’s financial needs and how their support helps achieve the church’s goals. Maintain transparency by regularly sharing financial reports with the congregation, showing how funds are being used and the impact they are having.

Effectively managing a church budget ensures financial stability and supports the church’s mission and activities. Here are some top tips for managing the church budget:

Regularly teach about biblical principles of stewardship and generosity. Use sermons, Bible studies, and workshops to emphasize the importance of giving.

In conclusion, managing your church’s finances with diligence and wisdom is a vital part of stewarding God’s resources. As Proverbs 27:23-24 advises, “Be sure you know the condition of your flocks, give careful attention to your herds; for riches do not endure forever, and a crown is not secure for all generations.” By planning and budgeting carefully, your church can ensure financial health and sustainability. This comprehensive church budget template accompanying this post is designed to simplify this process and make it easier for you to track income, manage expenses, and make informed financial decisions. Take advantage of this valuable resource to enhance transparency, support your church’s missions, and build trust within your congregation.